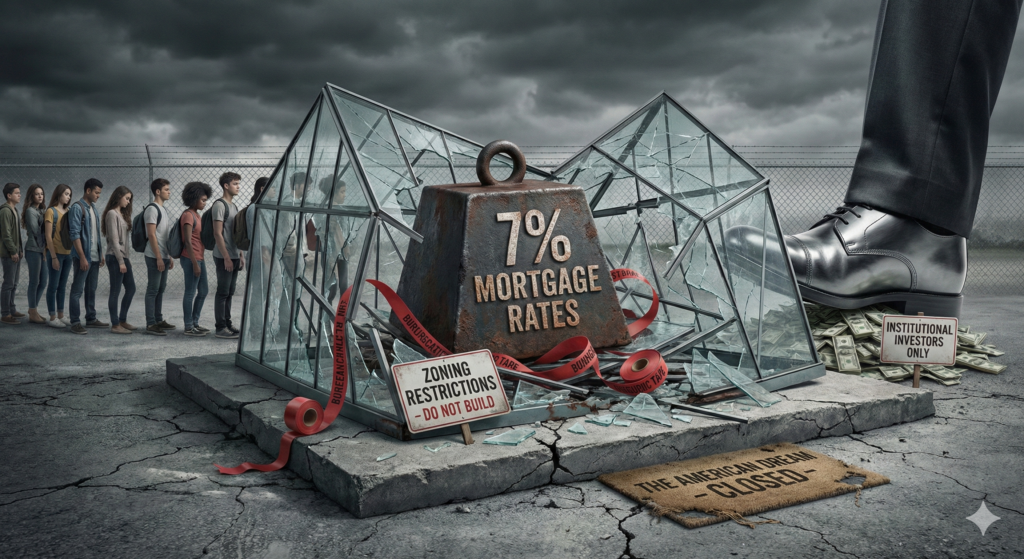

For decades, the quintessential milestone of the “American Dream” was clear: buying a home. It was the primary vehicle for building generational wealth and achieving stability. Today, for millions of Millennials and Gen Z Americans, that dream feels more like a financial hallucination (Housing)

The sentiment that young people are “priced out” of the market is not merely anecdotal frustration; it is an economic reality born from a perfect storm of systemic failures. It is not a crisis caused by buying too much avocado toast. It is a structural crisis defined by a severe lack of inventory. Punishing borrowing costs, outdated regulations, corporate competition, and soaring building expenses.

To understand why first-time homebuyers are hitting a brick wall, we must dissect the anatomy of the current US housing shortage.

The Foundation: A Multi-Million-Unit Housing Deficit

The most basic law of economics—supply and demand—is currently broken in the US real estate market. Simply put, there are far too many people chasing far too few homes.

The roots of this supply crisis stretch back to the Great Recession of 2008. Following the housing crash, residential construction ground to a halt. Many homebuilders went out of business, and construction workers left the industry. For roughly a decade, the United States underbuilt housing relative to population growth.

While household formation (young people moving out and wanting their own space) accelerated, new builds failed to keep pace. Estimates vary, but housing economists generally agree that the US is facing a housing deficit ranging from 3 million to over 5 million units.

This chronic under-supply means that even with cooled demand, competition remains fierce for entry-level homes, keeping prices stubbornly high.

The Mortgage Vise: High Rates and the “Lock-In” Effect

If the lack of supply set the stage for high prices, the recent surge in mortgage interest rates slammed the door shut for many aspiring buyers.

To combat post-pandemic inflation, the Federal Reserve aggressively raised interest rates. The average 30-year fixed mortgage rate more than doubled from historic lows of around 3% in 2021 to highs fluctuating between 6.5% and 8%. This shift has had two devastating impacts on the market:

1. Crushing Purchasing Power

For a first-time buyer, the difference between a 3% rate and a 7% rate is catastrophic to their budget. On a $400,000 loan, that rate jump increases the monthly principal and interest payment by roughly $1,000. To afford the same house built three years ago, a buyer today needs a significantly higher income.

2. The “Lock-In” Effect Freezing Inventory

Millions of Americans bought or refinanced their homes when rates were under 4%. These homeowners now wear “golden handcuffs.” Even if they want to move, they are economically disincentivized to trade a 3% mortgage for a 7% one. This has paralyzed the resale market, keeping existing inventory off the market and worsening the supply shortage dramatically.

The Battlefield: Local Zoning and NIMBYism

If we need millions of new homes to fix the deficit, why aren’t we just building them? The answer lies in a complex web of local regulations, zoning laws, and community opposition.

In many of the highest-demand job centers in the US, archaic zoning laws prohibit the construction of anything other than single-family detached homes on large lots. These rules make it illegal to build the types of housing that first-time buyers desperately need: duplexes, townhomes, small apartment buildings, and accessory dwelling units (ADUs).

This regulatory stranglehold has created a lack of “missing middle” housing. Efforts to reform these zoning laws often face intense local backlash, also known as NIMBYism (Not In My Back Yard). Existing residents often oppose new developments, fearing increased traffic or a decrease in property values. These political battles add years of delays to any new development.

The Wall Street Landlord: Institutional Investors

Young Americans aren’t just competing against each other for scarce inventory; they are increasingly bidding against Wall Street.

Following the 2008 crash, private equity firms and large institutional investors began buying up distressed single-family homes to convert them into rental properties. This trend accelerated during the pandemic. Today, corporate investors account for a significant percentage of home purchases in fast-growing Sun Belt cities like Atlanta, Charlotte, and Phoenix.

These institutions often pay in all-cash, waiving inspections and closing quickly. So a first-time homebuyer relying on an FHA loan or a standard 30-year mortgage simply cannot compete with a multi-billion-dollar hedge fund’s cash offer. By turning potential starter homes into permanent corporate rentals, these investors are siphoning crucial entry-level inventory away from everyday Americans.

The Cost to Build: Labor Shortages and Material Inflation(Housing)

Even in areas where zoning laws are favorable and land is available, the physical act of building a home has never been more expensive.

Thus, the construction industry is facing a massive, structural labor shortage. As older tradespeople—framers, electricians, plumbers, and roofers—retire. So there are not enough young workers entering the trades to replace them. This lack of skilled labor heavily delays project timelines and drives up wages, costs that are ultimately passed on to the buyer.

Furthermore, supply chain volatility over the past few years has caused the price of raw materials, from lumber to concrete to copper wiring, to wildly fluctuate. When developers face unpredictable material costs and a severely constrained labor pool, building affordable, entry-level “starter homes” becomes financially unviable. Instead, builders are forced to focus on high-margin, luxury properties just to turn a profit, entirely bypassing the demographic that needs housing the most.

Conclusion: Rethinking the American Dream of Housing

The narrative that young Americans are simply not saving enough to buy a house ignores the harsh economic realities of the modern housing market. So the barrier to entry is no longer just a down payment; it is navigating a historic, multi-million-unit housing deficit. So surviving punishing interest rates, outbidding cash-rich corporate investors, and waiting for an overburdened construction sector to navigate local zoning red tape.

Solving the US housing shortage will require a multi-faceted approach. It demands federal incentives to boost the construction trades, state-level interventions to override restrictive NIMBY zoning laws, and potential legislation to limit corporate monopolies on single-family homes.

Until these structural, systemic issues are addressed, the traditional American Dream of homeownership will remain on pause for a generation. Young buyers aren’t failing to participate in the market; the market is currently designed to keep them out.